Unlock Financial Liberty: Your Comprehensive Guide to Credit Repair

Unlock Financial Liberty: Your Comprehensive Guide to Credit Repair

Blog Article

The Trick Advantages of Credit History Fixing and Its Effect On Your Financing Eligibility

In today's economic landscape, understanding the intricacies of credit rating repair work is vital for any person seeking to boost their financing qualification. By attending to usual credit rating report errors and improving one's credit report, individuals can unlock a variety of benefits, including access to more beneficial funding alternatives and passion prices. Nonetheless, the effects of these renovations expand past simple numbers; they can essentially change one's financial trajectory. As we explore the complex partnership in between credit score fixing and financing qualification, it ends up being apparent that the trip in the direction of monetary empowerment is both important and complex. What actions can be required to optimize these benefits?

Recognizing Credit Scores

Credit report are a vital part of personal financing, acting as a mathematical depiction of an individual's creditworthiness. Typically varying from 300 to 850, these ratings are calculated based on different elements, consisting of settlement history, credit score application, size of credit report, kinds of debt, and current questions. A greater credit rating suggests a reduced risk to loan providers, making it much easier for individuals to secure fundings, credit rating cards, and beneficial passion rates.

Recognizing debt ratings is crucial for effective financial management. A score over 700 is usually taken into consideration excellent, while ratings listed below 600 may prevent one's ability to obtain credit report.

Routinely monitoring one's credit history can give insights right into one's economic health and emphasize locations for improvement. By keeping a healthy credit rating, people can enhance their economic opportunities, safeguard better finance conditions, and inevitably attain their financial goals. Hence, an extensive understanding of credit report is crucial for any individual looking to browse the complexities of individual finance effectively.

Usual Credit Score Report Errors

Mistakes on credit history records can dramatically impact a person's credit report and total economic health. These errors can arise from various sources, including data access mistakes, obsoleted details, or identification burglary. Typical kinds of mistakes consist of inaccurate personal information, such as wrong addresses or misspelled names, which can bring about complication concerning an individual's credit rating.

An additional frequent issue is the misreporting of account statuses. For instance, a shut account might still look like open, or a prompt repayment may be incorrectly recorded as late. In addition, accounts that do not come from the individual, usually due to identification burglary, can significantly distort credit reliability.

Replicate accounts can likewise create disparities, leading to inflated financial obligation levels. Additionally, outdated public documents, such as bankruptcies or liens that need to have been eliminated, can linger on credit report reports longer than acceptable, detrimentally influencing credit score scores.

Provided these potential mistakes, it is critical for individuals to routinely assess their credit reports for mistakes. Recognizing and remedying these inaccuracies quickly can aid maintain a much healthier credit history account, ultimately influencing financing eligibility and safeguarding beneficial rates of interest.

Benefits of Credit Rating Repair Service

Furthermore, a more powerful credit score score can lead to boosted access to debt. This is especially advantageous for those seeking to make significant purchases, such as automobiles or homes. Furthermore, having a healthy credit rating can decrease the demand or eliminate for down payment when authorizing rental arrangements or setting up utility solutions.

Beyond instant monetary benefits, people that take part in credit score fixing can also experience a renovation in their overall economic proficiency. As they learn more about their credit scores and economic management, they are better geared up to make educated choices progressing. Eventually, the advantages of credit fixing prolong beyond numbers; they foster a sense of empowerment and stability in personal financing.

Influence On Loan Qualification

A strong credit score profile significantly influences loan eligibility, affecting the conditions under which lenders are ready to authorize applications. Lenders use credit rating and reports to examine the risk associated with offering to an individual. A greater credit history generally associates with far better finance alternatives, such as reduced rate of interest and more favorable settlement terms.

On the other hand, an inadequate credit report can cause greater rates of interest, bigger deposit requirements, or outright finance denial. Credit Repair. This can impede an individual's ability to safeguard essential financing for considerable acquisitions, such as cars or homes. A suboptimal credit report account might restrict access to numerous kinds of finances, including personal car loans and credit rating cards, which can additionally perpetuate economic problems.

By dealing with mistakes, resolving impressive debts, and establishing a favorable payment history, individuals can enhance their credit history ratings. Comprehending the influence of credit report wellness on lending eligibility highlights the importance of positive debt management techniques.

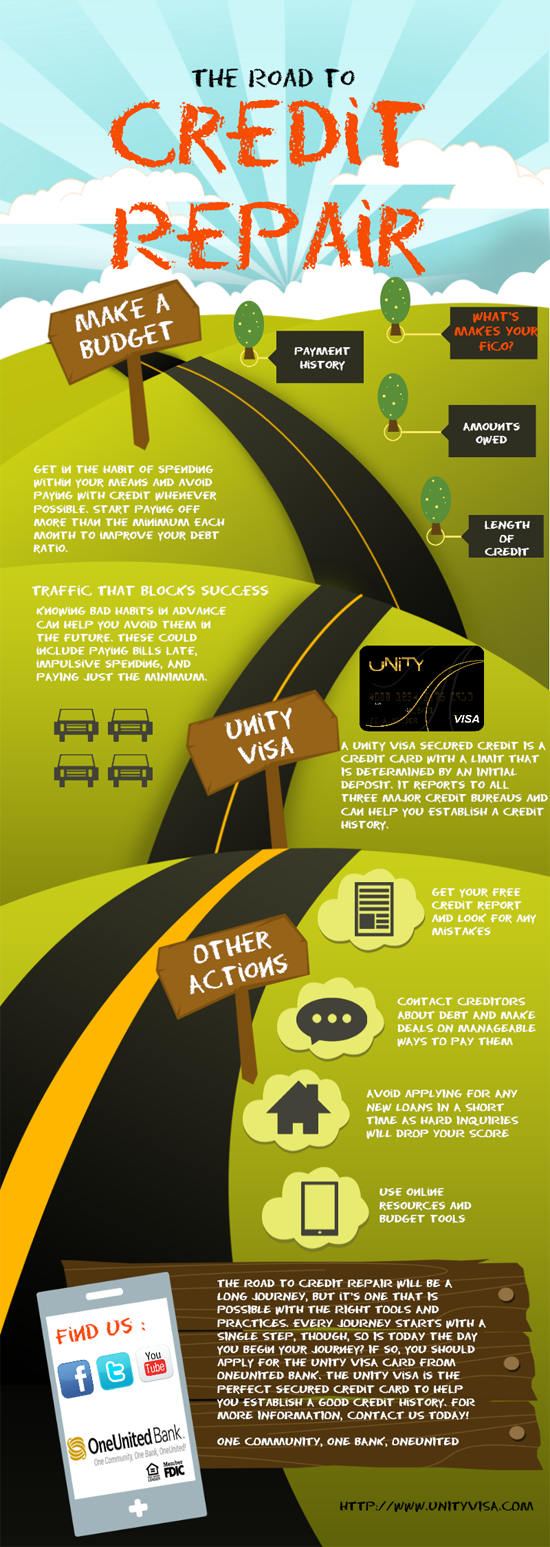

Actions to Beginning Debt Repair Work

Countless people seeking to enhance their credit report can take advantage of click over here an organized method to credit rating fixing. The primary step entails getting a copy of your credit rating report from all three major debt bureaus: Experian, TransUnion, and Equifax. Evaluation these reports for errors or discrepancies, as mistakes can negatively influence your score.

Following, recognize any kind of arrearages and prioritize them based on urgency and quantity. Get in touch with lenders to work out repayment plans or negotiations, which can be a critical action in showing duty and dedication to settling financial debts.

When inaccuracies are identified, data disputes with the credit bureaus - Credit Repair. Offer paperwork to sustain your claims, as this may accelerate the elimination of wrong entries

In addition, develop a budget plan to make certain prompt payments relocating onward. Regular, on-time repayments will considerably enhance your credit report over time.

Last but not least, think about looking for expert aid from a reputable credit score repair firm if DIY approaches prove overwhelming. While this might sustain added prices, their competence can improve the process. By adhering to these actions, people can read the full info here properly improve their debt profile and lead the way for far better finance qualification.

Conclusion

In verdict, credit score repair offers as an important tool for enhancing credit report ratings and improving loan eligibility. By resolving common credit history record errors and promoting economic proficiency, individuals can accomplish much better loan options and positive settlement terms.

By addressing common credit history record mistakes and boosting one's credit rating score, individuals can unlock a variety of advantages, consisting of accessibility to extra favorable car loan choices and rate of interest prices. Normally varying from 300 to 850, these ratings are computed based on numerous variables, consisting of settlement background, credit history use, size of debt background, kinds of credit scores, and recent inquiries. A higher credit rating score indicates a reduced threat to lending institutions, making it easier for people to safeguard loans, credit rating cards, and favorable interest prices.

Boosted debt ratings commonly result in a lot more beneficial interest prices on financings and credit scores products.In conclusion, credit fixing offers as an important device for improving credit history scores and enhancing funding eligibility.

Report this page